mango drank

Member

All right, which of y'all paper hands-y momofukus is behind this?

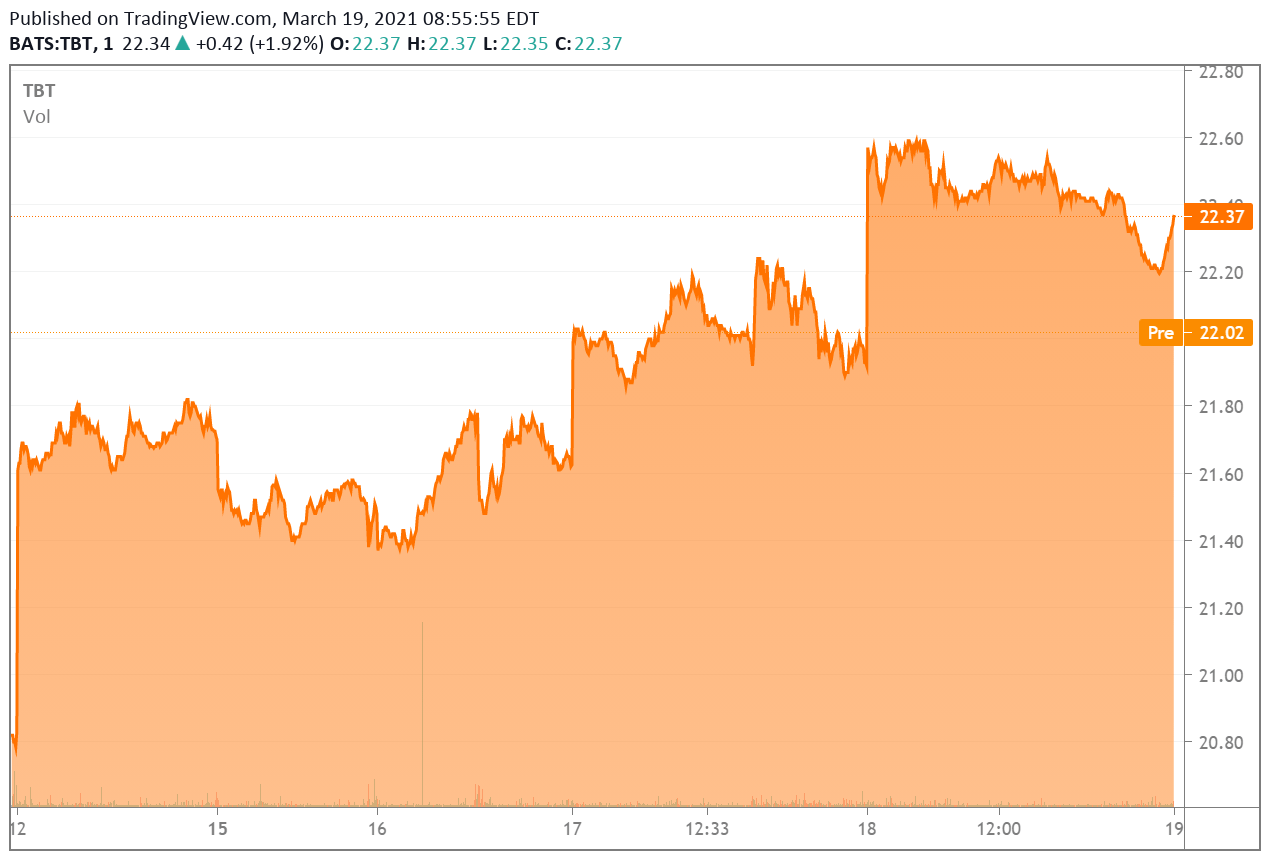

I hope oil shows up to that party.After hours looking tasty.

Today was to shake out the first timers to the market after the stimulus this week.

Tomorrow we party.

Anyone just straight up trade Tesla on rapid fire? I am considering a little play investment to just buy and sell the highs and lows of Tesla. So volatile that if you have access to cheap trades I swear you could just flip it minute by minute or day by day or week to week and build a nice growth out it. I'm fucking tempted to see how I'd go. Might just buy a couple/few shares to toy around with e.g. in the last couple of days alone there has been swings of approx $50-$100 per share at any given time.

That's pretty much the reason why I bought one share today, just as a little experimentation. My thinking is if I get stuck with it for a while then... I'm stuck with it for a while, it's Tesla.

I'll see how it behaves over the next couple of days and then go from there.

But yeh, a lot of people exclusively day trade/scalp Tesla because of how volatile it is intraday.

Depends on the time line. But I get what youre asking.

I'm about 25% above pre-covid levels. Just off my all time high. Not as good as people who caught on with tech stocks, but at one time I was -40% a year ago to this day. I think lunch time March 18, 2020 was rock bottom day.

Since rock bottom, my portfolio has roughly doubled.

Thanks for the reply. But I rather wanted to know the absolute monetary values that are also spent on life, leisure and fun and not percentages.

My experience is simply that many are always enthusiastic about certain forms of investment, but then somehow forget to enjoy themselves with the money earned. Others overvalue everything and don't even realize that alternatives would have been better and more effective for them. And there are others who are always happy when stocks etc. go up, but the bottom line is that they hardly earn a real cent that they can spend on other things...and that should be the ultimate goal.

Eh, most people here work day jobs too. There's such a thing as retirement you know, not to mention other responsibilities like family, mortgages, home repair.Thanks for the reply. But I rather wanted to know the absolute monetary values that are also spent on life, leisure and fun and not percentages.

My experience is simply that many are always enthusiastic about certain forms of investment, but then somehow forget to enjoy themselves with the money earned. Others overvalue everything and don't even realize that alternatives would have been better and more effective for them. And there are others who are always happy when stocks etc. go up, but the bottom line is that they hardly earn a real cent that they can spend on other things...and that should be the ultimate goal.

Chinese Military bans Tesla cars in its complexes on concern over interior camera

- Tesla (NASDAQ:TSLA) +0.8% premarket, has been banned from Chinese military complexes and housing compounds on fear of sensitive data being collected by cameras built into the vehicles - Bloomberg.

- Tesla car owners are ordered to park their car outside of military property.

- Most of the Tesla models have an interior camera mounted above the rear view mirror.

- Earlier today, Geely announces launching new electric vehicle to compete with Tesla.

I purposely avoided not stating $$$ amounts.Thanks for the reply. But I rather wanted to know the absolute monetary values that are also spent on life, leisure and fun and not percentages.

My experience is simply that many are always enthusiastic about certain forms of investment, but then somehow forget to enjoy themselves with the money earned. Others overvalue everything and don't even realize that alternatives would have been better and more effective for them. And there are others who are always happy when stocks etc. go up, but the bottom line is that they hardly earn a real cent that they can spend on other things...and that should be the ultimate goal.

I purposely avoided not stating $$$ amounts.

Like most people in this thread, I dont. We usually state %'s and have fun chatting stocks.

Why would we want to to tell you our portfolio size and how we spend our money? Looking at your posting history, the only time you've posted in this thread is to asking how much in dollar value we are making. And why would you ask for a friend? And why would he care either?

I purposely avoided not stating $$$ amounts.

Like most people in this thread, I dont. We usually state %'s and have fun chatting stocks.

Why would we want to to tell you our portfolio size and how we spend our money? Looking at your posting history, the only time you've posted in this thread is to asking how much in dollar value we are making. And why would you ask for a friend? And why would he care either?

Those are stupid assumptions to make.In case it wasn't obvious enough, I personally don't think too much of the sometimes enormous glorification that has nothing to do with reality. Sometimes I get the impression that a lot of people waste their time talking about money, stocks and trends instead of really making money and living.

I do a little with stocks and funds, but I feel more comfortable with the sale and rental of real estate (but of course that depends on personal preferences and the country in which you live). I have also only briefly glanced over the thread and always find it a bit questionable when people who have no idea of the matter could get the impression that everyone can quickly make a lot of money with it.

This is of course only my personal opinion and should not represent any attack or the like on anyone here.

If you dont do stocks much, then maybe you shouldnt open your mouth.I do a little with stocks and funds, but I feel more comfortable with the sale and rental of real estate (but of course that depends on personal preferences and the country in which you live).

Thanks for the reply. But I rather wanted to know the absolute monetary values that are also spent on life, leisure and fun and not percentages.

My experience is simply that many are always enthusiastic about certain forms of investment, but then somehow forget to enjoy themselves with the money earned. Others overvalue everything and don't even realize that alternatives would have been better and more effective for them. And there are others who are always happy when stocks etc. go up, but the bottom line is that they hardly earn a real cent that they can spend on other things...and that should be the ultimate goal.

Up +1%. Not a great week if it holds. Probably still down 2%-ish.Up 1.49% so good day so far.

Up +1%. Not a great week if it holds. Probably still down 2%-ish.

Got any idea why? I was considering buying some PFSI (They manage my mortgage) they spiked yesterday and PLUMMETED today. Looks like a lot of financials are in the same boat.With exception of COWN, my financials getting smoked today.

Got any idea why? I was considering buying some PFSI (They manage my mortgage) they spiked yesterday and PLUMMETED today. Looks like a lot of financials are in the same boat.

How much profit have you guys already made?

And I mean pure cash, which has not been reinvested.

Asking for a friend.