You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock-Age: Stocks, Options and Dividends oh my!

- Thread starter koam

- Start date

jamesinclair

Banned

Frankfurter said:VW continued that crazy way today. It peaked at ~1000 per share, so going by market cap was afaik by far the largest company in the world. Currently it's at ~750, so still 45% up compared to yesterday (where it had +150% :lol ).

Btw. apparently the reason for this crazy thing going on is that certain Hedge Fonds apparently need to buy Volkswagen at EVERY price to fulfill 'orders' or sth. like that by Porsche. I really don't get it, but some guys in German boards say that Porsche more or less trapped the Hedge Fonds by announcing their current state at overtaking VW (less than expected shares are still available on the market).

Up 406.50 (58.87%)

Fuck you GAF, why didnt you recommend them. I could have been set for the year

Ether_Snake

å®å®å®å®å®å®å®å®å®å®å®å®å®å®å®

ABX up 8% but I don't know why, gold isn't up that much today so far. ATVI still down, ridiculous.

EDIT: I think this is a fool's rally, there is only bad news today. This rally is from people who see virtual "low value" hoping that everyone does the same so they can sell a few hours later. That's what I think.

EDIT2: My PS3's disc drive is dead! Argh

EDIT: I think this is a fool's rally, there is only bad news today. This rally is from people who see virtual "low value" hoping that everyone does the same so they can sell a few hours later. That's what I think.

EDIT2: My PS3's disc drive is dead! Argh

Ether_Snake said:EDIT: I think this is a fool's rally, there is only bad news today. This rally is from people who see virtual "low value" hoping that everyone does the same so they can sell a few hours later. That's what I think.

More than likely. I don't believe any rally we get will last through a single trading session.

*sigh* it is looking that way. I'm just going to let my holdings marinate for awhile. Hopefully I can just break even by the end of next year.ArtG said:More than likely. I don't believe any rally we get will last through a single trading session.

Frustrating to see that some of the money I added into my account has disappeared. But... could have been worse! Looking forward to a few years from now when the dust settles.

Everybody hates Zecco: http://www.zecco.com/forums/327/ShowForum.aspx

Ether_Snake

å®å®å®å®å®å®å®å®å®å®å®å®å®å®å®

Deku Tree said:Everybody hates Zecco: http://www.zecco.com/forums/327/ShowForum.aspx

I guess free trades is too good to be true

Deku Tree said:Everybody hates Zecco: http://www.zecco.com/forums/327/ShowForum.aspx

That was a bad week, but they made up for it with the month of free stock trades. I've made 44 so far.

RumblingRosco

Member

I agree, I don't see today's rally holding out, or at the least, I'm sure it will be a bad day tomorrow if today does hold positive. I still feel today's prices are ones that will pay off in the long-term, for almost any of the blue-chip stocks. I've got a small pile of large-cap blue-chips in my portfolio, now I'm looking very very closely at small-cap stocks that I think can weather this storm and make large gains in 10-20 years. I mean, so is everyone else, but you guys get the point. :lol

argon said:It's hard to believe that the Dow hasn't had two successive up days in over a month. I'll go out on a limb and guess the market will rally a bit from here. It has dropped too far, too fast.

I've thought this for a while now. Then the Dow tanks another 500-1,000 points.

Ether_Snake

å®å®å®å®å®å®å®å®å®å®å®å®å®å®å®

Everything I'm looking at is green right now. BWA, VCP, TGI and ABX are over 10% today.

Maybe it will close in the green

The day after I said "might as well short everything!".

EDIT: Damn you BHI, it's actually in the red.

Maybe it will close in the green

The day after I said "might as well short everything!".

EDIT: Damn you BHI, it's actually in the red.

Ether_Snake

å®å®å®å®å®å®å®å®å®å®å®å®å®å®å®

7.46%!

Considering the volatility and nothing specific driving the surge, there's no reason to expect it to stick.lil smoke said:Not really woth getting excited over though, is it? This is just a small % of what needs to be recovered. Or is DOW @ 8700 a good number for you guys now?

Frankfurter said:VW continued that crazy way today. It peaked at ~1000 per share, so going by market cap was afaik by far the largest company in the world. Currently it's at ~750, so still 45% up compared to yesterday (where it had +150% :lol ).

Btw. apparently the reason for this crazy thing going on is that certain Hedge Fonds apparently need to buy Volkswagen at EVERY price to fulfill 'orders' or sth. like that by Porsche. I really don't get it, but some guys in German boards say that Porsche more or less trapped the Hedge Fonds by announcing their current state at overtaking VW (less than expected shares are still available on the market).

The Hedge Funds got fucked. This will be a textbook case study on the short-squeeze for decades. Just ridiculous. Saw it hit 1,015Euro's at one point on my Reuters :lol

Ether_Snake

å®å®å®å®å®å®å®å®å®å®å®å®å®å®å®

avaya said:The Hedge Funds got fucked. This will be a textbook case study on the short-squeeze for decades. Just ridiculous. Saw it hit 1,015Euro's at one point on my Reuters :lol

I don't get what happened there.

btw are you an M&M now? :lolsonarrat said:No reason not to expect a further rally at the bell given the recent trend.

A co-worker walked in to my office today with a chart on his laptop from some newsletter that apparently costs 400 bucks a year to subscribe to, and has insider analysts giving the scoop on the current markert. Anyway, the article in question described how we are following the Great Depression almost to a T. The chart showed an overlay of both of them and how similar they are.

He concluded that in a few weeks, we will be much much much lower than we are now.

Thoughts?

He concluded that in a few weeks, we will be much much much lower than we are now.

Thoughts?

That's what my bro has been warning me about... he says to look for a 6000 bottom.oatmeal said:A co-worker walked in to my office today with a chart on his laptop from some newsletter that apparently costs 400 bucks a year to subscribe to, and has insider analysts giving the scoop on the current markert. Anyway, the article in question described how we are following the Great Depression almost to a T. The chart showed an overlay of both of them and how similar they are.

He concluded that in a few weeks, we will be much much much lower than we are now.

Thoughts?

lil smoke said:btw are you an M&M now? :lol

The origins of this avatar are more sinister than you could possibly imagine.

Ether_Snake

å®å®å®å®å®å®å®å®å®å®å®å®å®å®å®

lil smoke said:That's what my bro has been warning me about... he says to look for a 6000 bottom.

Yep, Roubini said the same (well he said another 20 to 30% down to go).

Ether_Snake said:I don't get what happened there.

Short-squeeze.

Porsche announced they used derivatives to build a ~75% stake in Volkswagen, pretty much polishing off the takeover that has taken forever.

Hedge Funds were generally short car makers because of the current climate. They all rushed to cover their short positions, buying anything in a mad rush to make sure they don't destroyed. Short-squeeze. The herd behaviour caused a huge spike in the price as they applied overwhelming buying pressure.

It's not something to be happy about, it's market manipulation taken to the extreme.

Ether_Snake

å®å®å®å®å®å®å®å®å®å®å®å®å®å®å®

I'd be happy if I had Volks shares!

DOW +9%!

BWA up 25%, VCP at 19%

DOW +9%!

BWA up 25%, VCP at 19%

Ether_Snake

å®å®å®å®å®å®å®å®å®å®å®å®å®å®å®

Wow, 10.5%! Is that a record?

EDIT: 11%! :lol

EDIT: 11%! :lol

RumblingRosco

Member

I think this has to be a record? Also, USD up 5.23% against the Yen, that has to be a near record for a one day gain.

avaya said:Short-squeeze.

Porsche announced they used derivatives to build a ~75% stake in Volkswagen, pretty much polishing off the takeover that has taken forever.

Hedge Funds were generally short car makers because of the current climate. They all rushed to cover their short positions, buying anything in a mad rush to make sure they don't destroyed. Short-squeeze. The herd behaviour caused a huge spike in the price as they applied overwhelming buying pressure.

It's not something to be happy about, it's market manipulation taken to the extreme.

I saw this a few weeks ago, don't remember the source though.

hermeez said:I saw this a few weeks ago, don't remember the source though.

Yes. It is quite comical.

Ether_Snake

å®å®å®å®å®å®å®å®å®å®å®å®å®å®å®

Ah now I get it. Sounds illegal, but probably isn't :lol

RumblingRosco

Member

hermeez said:I saw this a few weeks ago, don't remember the source though.

porsche.gif

Beautifully executed.

Porsche announce they have 75% holding in VW through options...

:lol

http://dealbreaker.com/2008/10/dont-mention-the-war.php

Porsche said:"The disclosure should give so-called short sellers... the opportunity to settle their relevant positions without rush and without facing major risks."

:lol

http://dealbreaker.com/2008/10/dont-mention-the-war.php

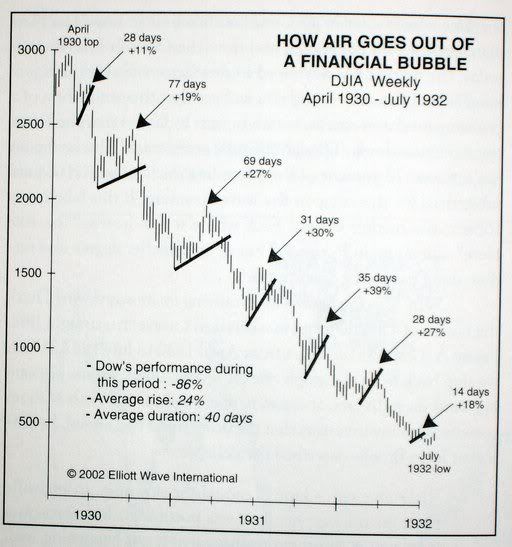

Kifimbo said:Today's rally reminds me of this.

Yeah? So I guess we should expect a bullish trend of at least 28 days, huh? How are your chocolate gold coins working out?

Ether_Snake

å®å®å®å®å®å®å®å®å®å®å®å®å®å®å®

Well the difference is we got +10% in one day, not over ten days

Good news about the LIBOR.

The next three weeks will be so important. The Nov. 15th meeting especially. Whatever comes out of it will depend on how the situation is by then.

avaya said:LIBOR is coming down very steadily and it's continuing to do so.

Equity volatility is expected since no one really know's how to price at the moment.

Good news about the LIBOR.

The next three weeks will be so important. The Nov. 15th meeting especially. Whatever comes out of it will depend on how the situation is by then.

avaya said:Second highest rise in history.

If the Fed cuts by 50bp or more tomorrow we will continue this and continue this further if ECB and BofE continue to cut.

Only thing, there was basically no volume today.

rally. I might hit 10 bu 11/1 yet (if that happens it will fucking plummet)

Ether_Snake

å®å®å®å®å®å®å®å®å®å®å®å®å®å®å®

Probably, but also I think that a major loss in the recent past leads to a strong desire for immediate short-term gains to make up for the recent loses, which leads to rallies when the market goes down to a certain level, only to lead to further drops soon after as people take their money out.

So we can expect, probably, even lower lows soon enough.

Nikkei up close to 600

So we can expect, probably, even lower lows soon enough.

Nikkei up close to 600

nextgeneration

Member

Nintendo is announcing earnings on Thursday. Let's see how the stock moves after earnings announcement. Should be very interesting:

http://www.forbes.com/feeds/ap/2008/10/29/ap5617439.html

http://www.forbes.com/feeds/ap/2008/10/29/ap5617439.html

Nintendo will probably lower their guidance on a stronger yen:

Asia and Europe up again today. Dead cat bounce?

Forbes said:The yen will also likely pressure the company's projections this year, which are currently based on an assumed exchange rate of 105 yen to the dollar and 160 yen to the euro. On Wednesday, the dollar was trading at 96.65 yen, while the euro stood at 122.6 yen. Credit Suisse estimates Nintendo's foreign exchange losses at 52.5 billion yen ($533.4 million) in the July-September period.

Asia and Europe up again today. Dead cat bounce?