Thick Thighs Save Lives

NeoGAF's Physical Games Advocate Extraordinaire

State of the market

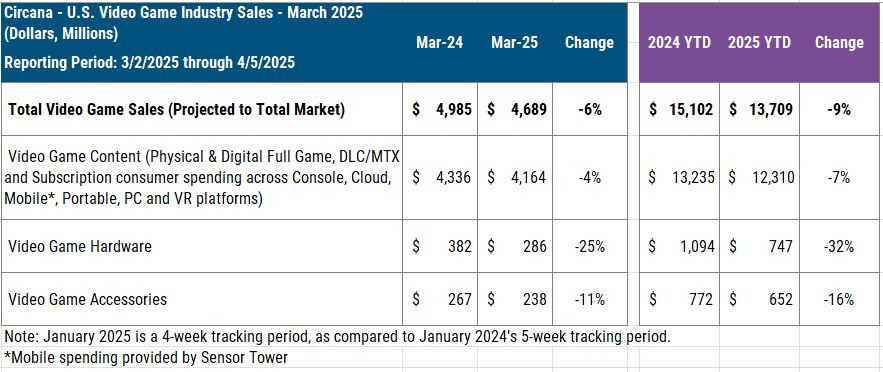

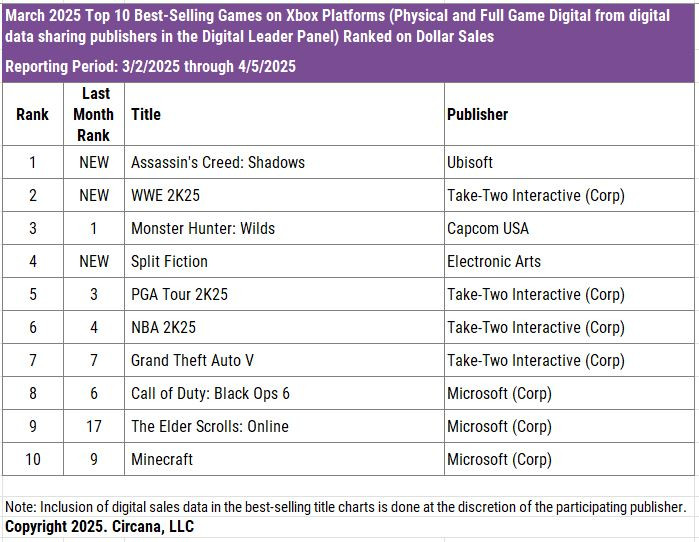

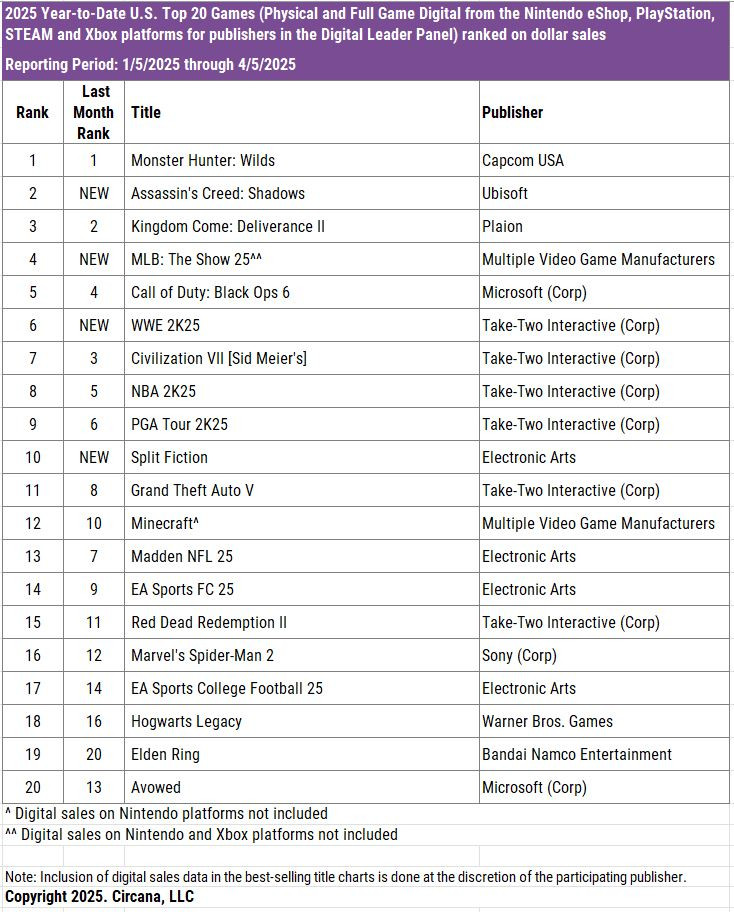

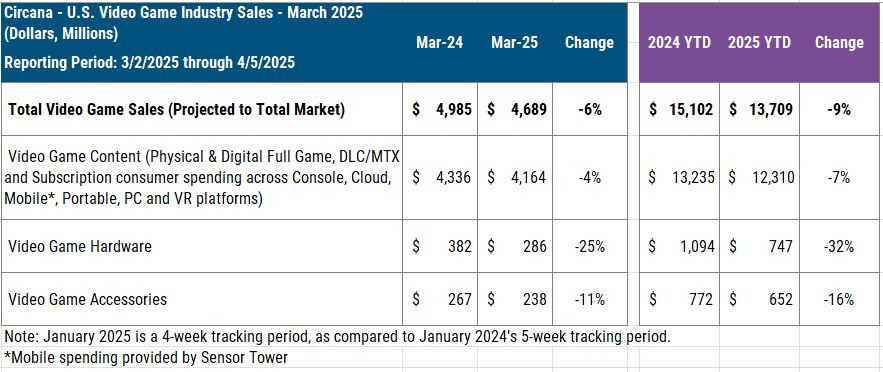

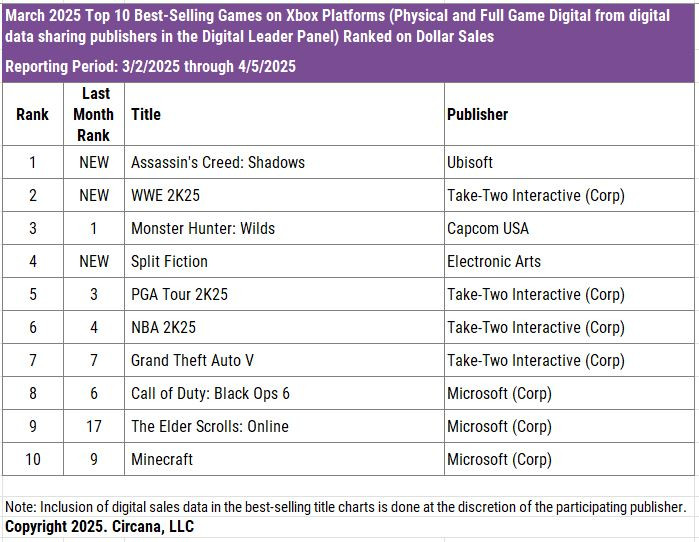

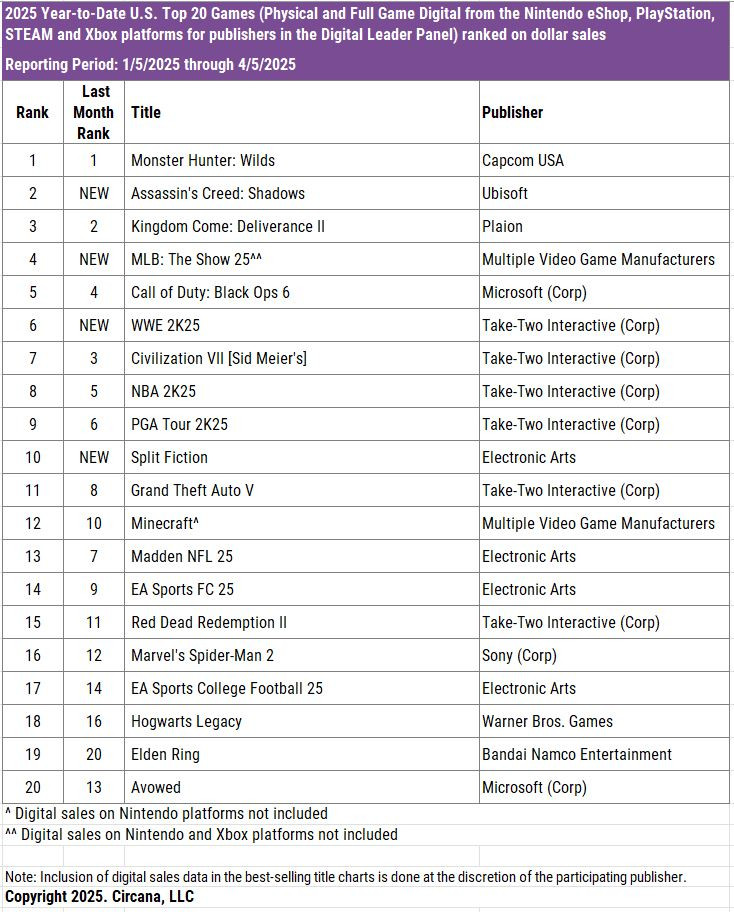

March 2025 projected U.S. consumer spending on video game hardware, content and accessories declined 6% when compared to YA, to $4.7B. Assassin's Creed: Shadows debuted as the best-selling game of March, ranking 2nd YTD.

March 2025 content spending fell 4% vs YA, to $4.2B. The only growth segments were non-mobile subscription (+11%) and console digital premium downloads (+12%). Mobile content finished 6% behind Mar 2024 (mobile source: Sensor Tower).

Hardware

March video game hardware spending fell 25% when compared to a year ago, to $286 million. This is the lowest March hardware spending total since 2019 ($279M). PlayStation 5 hardware dollar sales fell 26% in March vs YA, however the platform once again led the market in both dollar and unit sales. Xbox Series ranked 2nd in both measures with spending falling 9% year-on-year. Switch hardware sales dipped 37% compared to March a year ago.

Digital only SKUs have accounted for 75% of Xbox Series and 50% of PlayStation 5 hardware units sold year-to-date.

Software

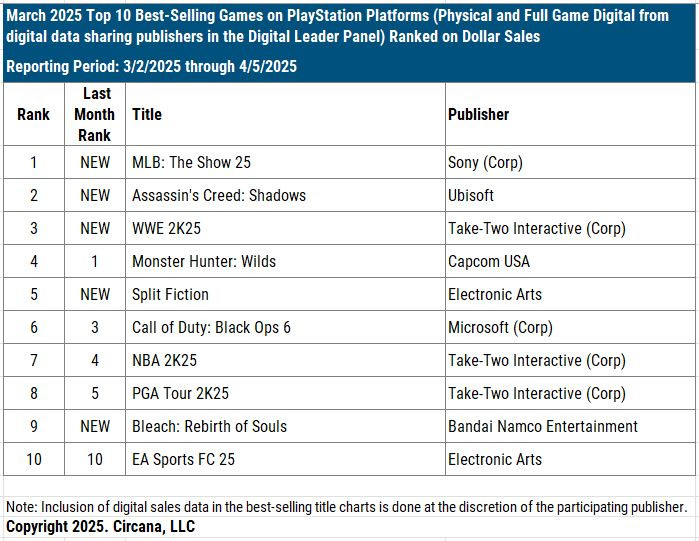

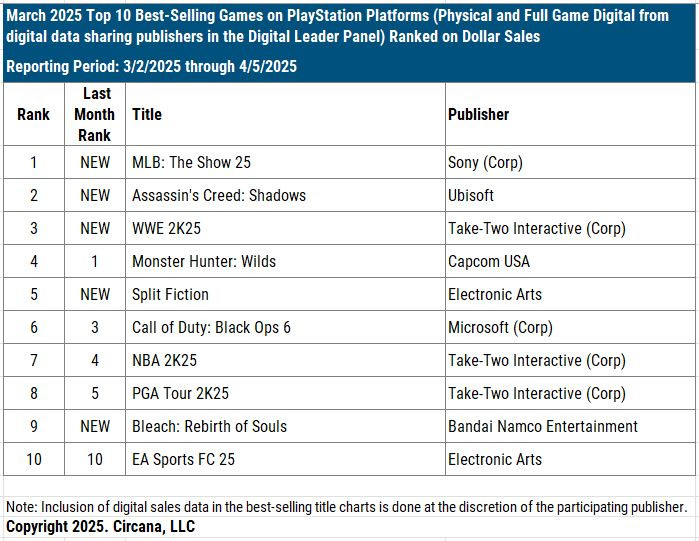

MLB The Show 25 ranked as the 2nd best-selling game of March and led all titles in full game dollar sales on PlayStation platforms. Tracked launch month dollar sales of MLB The Show 25 were 23% higher than those of MLB The Show 24 during its March 2024 debut period.

Mobile

Sensor Tower: Top 10 mobile games by U.S. spend in Mar and chg vs Feb: MONOPOLY GO!, Royal Match, Candy Crush Saga (+2), Last War: Survival (-1), Whiteout Survival (+1), Pokémon GO (+4), Coin Master (+2), Township, Pokémon TCG Pocket (-2), and Evony (+1).

"While March 2025 did represent a contraction in the US mobile games market over March 2024, the top games were, in general, doing quite well," said Samuel Aune of Sensor Tower. "Six out of the top ten saw double digit growth MoM, with Pokémon GO seeing 42% increase in consumer spend thanks to the Unova Tour event. Candy Crush Saga saw 12% growth, allowing the... game to retake the #3 spot from Last War: Survival, which only grew 1.6%," said Aune.

Accessories

Accessories spending in March fell 11% when compared to a year ago, to $238 million. Headset/Headphone spending led the decline, with dollar sales dropping 19% during the month when compared to March 2024. Year-to-date accessories spending is now 16% behind 2024's pace.

Black is in for Accessories. The PS5 Dual Sense Wireless Controller Midnight Black led all accessories in March consumer spending. The PS5 Dual Sense Edge Wireless Controller Midnight Black ranked 3rd, while the PS5 Portal Remote Player Midnight Black placed 4th overall.

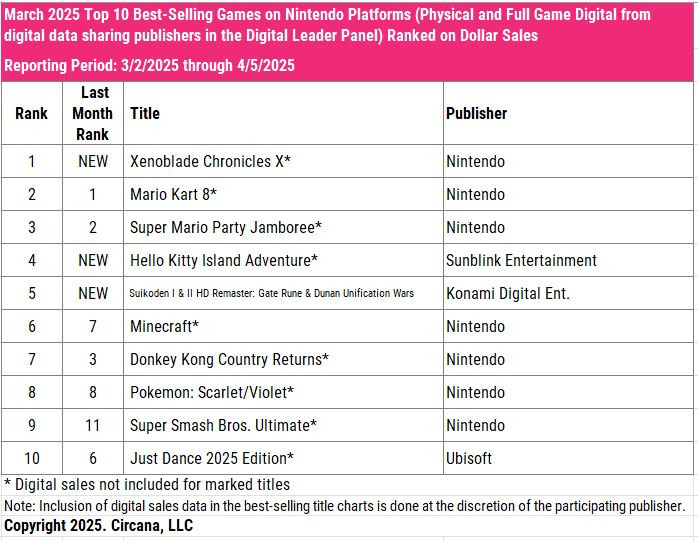

Software Charts

Year to Date

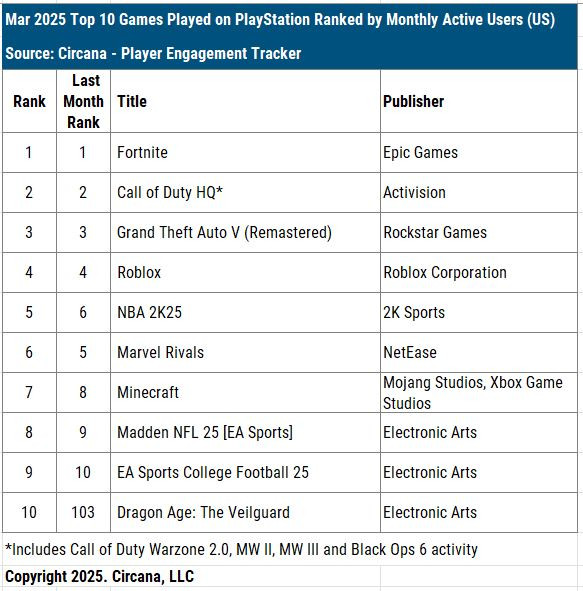

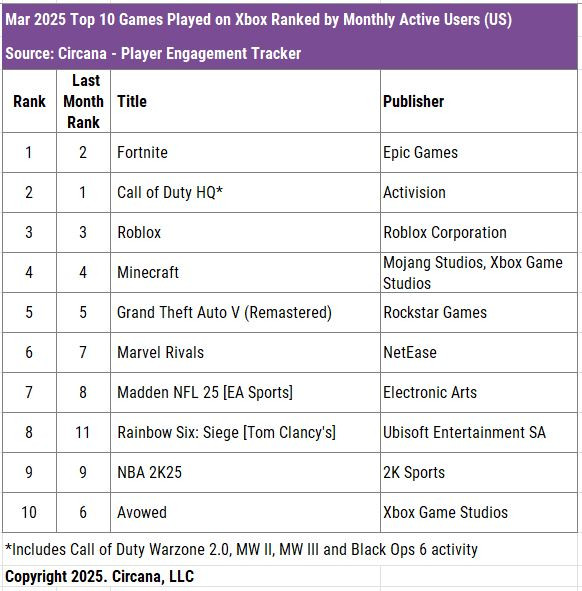

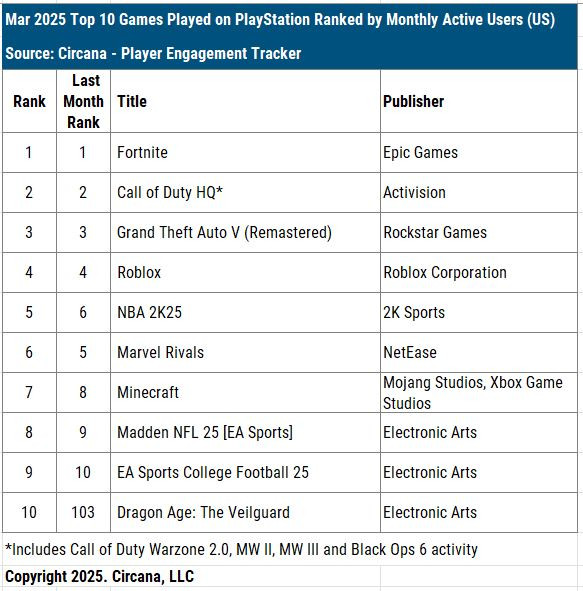

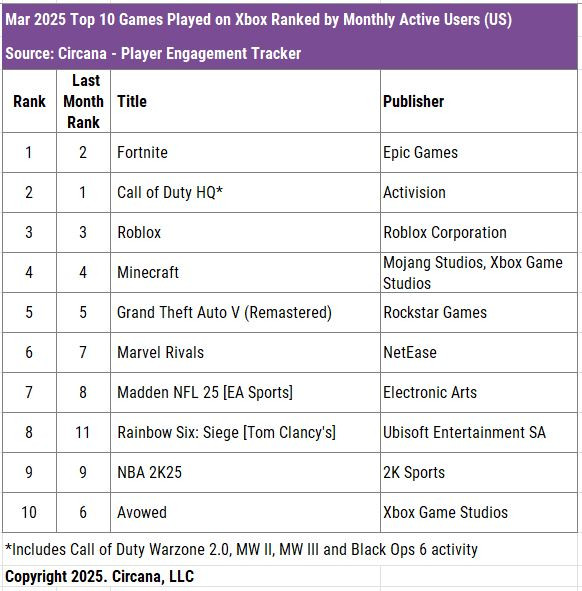

Monthly Active User Engagement

Rankings

Units: PS5 > XBS > NSW

Revenue: PS5 > XBS > NSW

Updates

Thanks Mat Piscatella and Welfare!

March 2025 projected U.S. consumer spending on video game hardware, content and accessories declined 6% when compared to YA, to $4.7B. Assassin's Creed: Shadows debuted as the best-selling game of March, ranking 2nd YTD.

March 2025 content spending fell 4% vs YA, to $4.2B. The only growth segments were non-mobile subscription (+11%) and console digital premium downloads (+12%). Mobile content finished 6% behind Mar 2024 (mobile source: Sensor Tower).

Hardware

March video game hardware spending fell 25% when compared to a year ago, to $286 million. This is the lowest March hardware spending total since 2019 ($279M). PlayStation 5 hardware dollar sales fell 26% in March vs YA, however the platform once again led the market in both dollar and unit sales. Xbox Series ranked 2nd in both measures with spending falling 9% year-on-year. Switch hardware sales dipped 37% compared to March a year ago.

Digital only SKUs have accounted for 75% of Xbox Series and 50% of PlayStation 5 hardware units sold year-to-date.

Software

MLB The Show 25 ranked as the 2nd best-selling game of March and led all titles in full game dollar sales on PlayStation platforms. Tracked launch month dollar sales of MLB The Show 25 were 23% higher than those of MLB The Show 24 during its March 2024 debut period.

Mobile

Sensor Tower: Top 10 mobile games by U.S. spend in Mar and chg vs Feb: MONOPOLY GO!, Royal Match, Candy Crush Saga (+2), Last War: Survival (-1), Whiteout Survival (+1), Pokémon GO (+4), Coin Master (+2), Township, Pokémon TCG Pocket (-2), and Evony (+1).

"While March 2025 did represent a contraction in the US mobile games market over March 2024, the top games were, in general, doing quite well," said Samuel Aune of Sensor Tower. "Six out of the top ten saw double digit growth MoM, with Pokémon GO seeing 42% increase in consumer spend thanks to the Unova Tour event. Candy Crush Saga saw 12% growth, allowing the... game to retake the #3 spot from Last War: Survival, which only grew 1.6%," said Aune.

Accessories

Accessories spending in March fell 11% when compared to a year ago, to $238 million. Headset/Headphone spending led the decline, with dollar sales dropping 19% during the month when compared to March 2024. Year-to-date accessories spending is now 16% behind 2024's pace.

Black is in for Accessories. The PS5 Dual Sense Wireless Controller Midnight Black led all accessories in March consumer spending. The PS5 Dual Sense Edge Wireless Controller Midnight Black ranked 3rd, while the PS5 Portal Remote Player Midnight Black placed 4th overall.

Software Charts

Year to Date

Monthly Active User Engagement

Rankings

Units: PS5 > XBS > NSW

Revenue: PS5 > XBS > NSW

Updates

Thanks Mat Piscatella and Welfare!