Background on the Byrd Rule Decisions

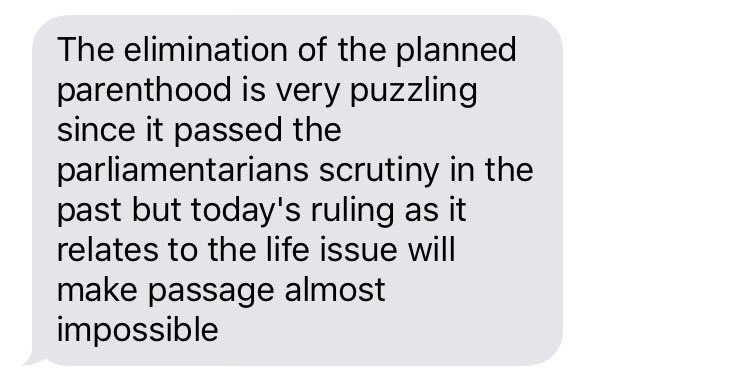

The parliamentarian has made a determination that certain provisions of the Republican "Better

Care Reconciliation Act" released on June 26, 2017, violate the Byrd Rule. This means that,

should the Senate proceed to the bill, these provisions may be struck from the legislation absent

60 votes.

Notably, the parliamentarian has advised that abortion restrictions on the premium tax credit and

the small business tax credit, and the language defunding Planned Parenthood, violate the Byrd

Rule. Further, the "Buffalo Bailout" which was used to secure votes in the House has also been

found to violate the Byrd Rule – threatening other state-specific buy-offs.

Provisions Subject to a 60-vote Byrd Rule Point of Order

• Defunding Planned Parenthood: This section prohibits Planned Parenthood from receiving

Medicaid funds for one year. (Sec. 124)

• Abortion Restrictions for Tax Credits: Two separate provisions contain Hyde Amendment

language to prevent premium tax credits and small business tax credits from being used to

purchase health insurance that covers abortion. (Sec. 102(d)(1) and Sec. 103(b))

• Sunset of Essential Health Benefits Requirement for Medicaid: This provision states that,

beginning in 2020, states no longer have to cover essential health benefits in their Medicaid

alternative benefit plans. (Sec. 126(b))

• Funding for Cost-Sharing Subsidies: This section replicates current law by providing

funding for the subsidies through 2019. (Sec. 208)

• Stabilizing the Individual Insurance Markets ("Six Month Lock Out"): This section

imposes a six-month waiting period for individuals attempting to enroll in coverage in the

individual market who cannot demonstrate that they have maintained continuous coverage.

(Sec. 206)

• Medical Loss Ratio: This section allows states to determine how much insurers are allowed

to spend on administration, marketing, and profits versus health care. (Sec. 205)

• Availability of Rollover Funds: This provision allows states that spend less than their

targeted block grant amount to rollover funds to the following year and to use funds for nonhealth

purposes, specifically repealing the provision of the Social Security Act that prohibits

states from using Medicaid funds to build roads, bridges, and stadiums. (Sec. 134 –

1903B(c)(2)(D)) (Note: this provision has been removed from the most recent draft).

• Decrease in Target Expenditures for Required Expenditures by Certain Political

Subdivisions ("Buffalo Bailout"): This provision limits the ability of New York State to

require counties other than New York City to contribute funding to the state's Medicaid

program. (Sec. 133 – 1903(c)(4))

• Grandfathering Certain Medicaid Waivers; Prioritization of HCBS Waivers: This

section says that the Secretary will encourage states to adopt Medicaid Home and

Community Based Services (HCBS) waivers but does not set forth any actual details for this

plan. (Sec. 136)

• Reporting of CMS-64 Data (T-MSIS): This provision requires the Secretary of HHS to

submit a report on Congress recommending whether expenditure data from the Transformed

Medicaid Statistical Information System (T-MSIS) is preferable to data from state CMS-64

reports for making certain Medicaid decisions. (Sec. 133 – 1903(h)(5))

Provisions Not Subject to a 60-vote Byrd Rule Point of Order

• Medicaid Work Requirements: This provision allows states the option to impose work

requirements on Medicaid enrollees who are nondisabled, nonelderly, and nonpregnant.

Pregnant women are exempt from any work requirements for 60 days after giving birth. (Sec.

131)

• Providing Safety Net Funding for Non-Expansion States – This section provides $10

billion for non-expansion states. (Sec. 129)

• State Stability and Innovation Fund: This section includes abortion restrictions on funding

for the State Stability and Innovation Fund by tacking the Fund onto the CHIP program.

(Sec. 106)

• Equity Adjustment: This provision provides for adjusting the per capita cap targets of lowand

high-spending states to promote equity. (Sec. 133 – 1903(c)(5))

• Repeal of Cost-Sharing Subsidy Program: This section permanently repeals cost-sharing

subsidies beginning in 2020. (Sec. 209)

• Reporting of CMS-64 Data: This provision requires states to include information on per

capita cap enrollment and expenditures, psychiatric hospital expenditures, and children with

complex medical conditions in their Medicaid expenditure reports. (Sec. 133 -- 1903(h)(1))

Still Under Review

• Waivers for State Innovation (Essential Health Benefits): This section amends Sec. 1332

of the ACA to allow states to waive age rating, essential health benefits, and pre-existing

condition requirements so long as their proposal does not increase the federal deficit. (Sec.

207)

• Small Business Health Plans: This section would allow small businesses to establish

"association health plans" that could be sold across state lines. For regulatory purposes, these

plans would be treated as part of the large group market and thus would be exempt from

many ACA requirements such as covering essential health benefits. (Sec. 139)

• Change in Permissible Age Variation in Health Insurance Premium Rates ("Age Tax"):

This section allows insurers to charge older Americans at least five times more than what

they charge younger individuals. (Sec. 204)

• Flexible Block Grant Option for States: This section allows states the option to receive a

lump sum Medicaid "block grant" instead of the per capita cap payments. (Sec. 134)